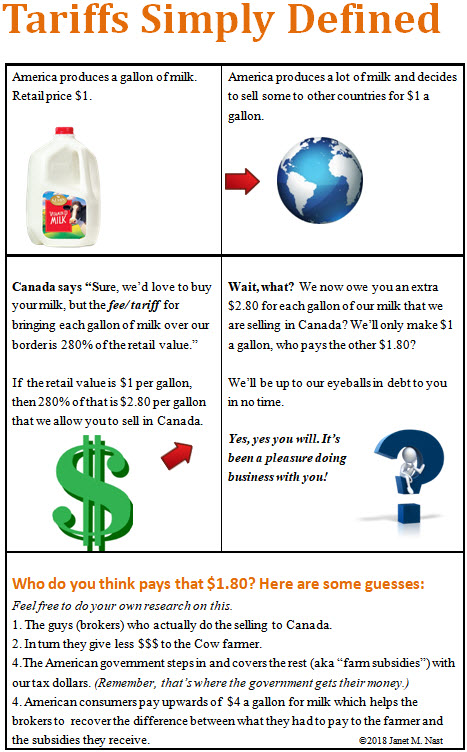

In the small example shown here, American farmers are losing big time: The only people making money on milk produced in America is Canada.

Unless of course, the farmers can pass on some of the cost to their neighbors, also known as, citizens of the US. They do that by charging the $1 per gallon plus a $3 service fee/ markup, or whatever you want to call it. Regardless, now the average American is paying $4 for a gallon of milk.

This may seem like a small amount, but take a look at higher ticket items such as cars. Yes, we may sell them to Mexico, but we have to pay them a fee, aka, “tariff,” for letting us sell our products in their country. Oh, and never mind that our “American cars” are built in Mexico, we are still charged a tariff for selling them there! That fee is then rolled into the cost of cars for Americans, not to mention the debt our government is racking up for each tariff we pay on each car shipped back and sold there. Seriously???

The problem is that the fees we pay other countries are so high, that our farmers and manufacturers can’t charge us enough to cover them... thus the farmers and manufacturers, and us as Americans, are in debt to those other countries. When the politicians are talking about “trade deficit” being in the billions of dollars to other countries, that is what they are talking about.

Now, in my opinion, if one wants to be fair when it comes to trade with other countries these taxes should never exceed half the normal retail cost of a product. Even 50% at most would still be fair coming or going. According to Wikipedia, tariffs hit about 44% for imports (that’s us charging them) during the civil war, and between 1871 to 1913 they were lower but never dropped below 38 percent.

So if we had to pay, say ideally, a 20% tax on anything we ship into another country, (20 cents on a $1 gallon of milk) we would still make money without having to charge Americans so much for that product in order to make up the difference.

The same could be said for products we receive from other countries: Japan makes cars. America charges them, and they might pay us, say, a $6,000 tariff for every $30,000 car that lands in America. Theoretically, we, American resellers, are making money on each car. And over in Japan, they have to eat that cost by passing it on to their local residents. But the cars can still be reasonably priced.

Where this gets ugly, as shown in the example of the milk, is when the cost to send (export) our products to Canada, Mexico, the UK, or any other country, is almost three times the actual cost of the product here in America. Which is what’s happened with a lot of the import/export/trade agreements America has with other countries. Now we owe them money for the products we make here and ship to them; that’s called a huge debt known as a trade deficit. It’s that simple.

According to the NY Times (https://www.nytimes.com/2018/06/09/upshot/what-is-the-trade-deficit.html) we have a $69 billion United States trade deficit with Mexico and a $336 billion gap with China.

The only thing I will say to that is that I sure wouldn’t be running my business like that.

I hope this information goes towards helping you to understand this issue a little bit better.