Such as COVID19, the Flu, and the Common Cold

There’s been an overwhelming amount of commercials and PSA’s on radio and TV all focusing on hand washing and social distancing to stay healthy. But there are quite a few other things that you can all do to ensure a better outcome if you do happen to pick up a nasty bug.

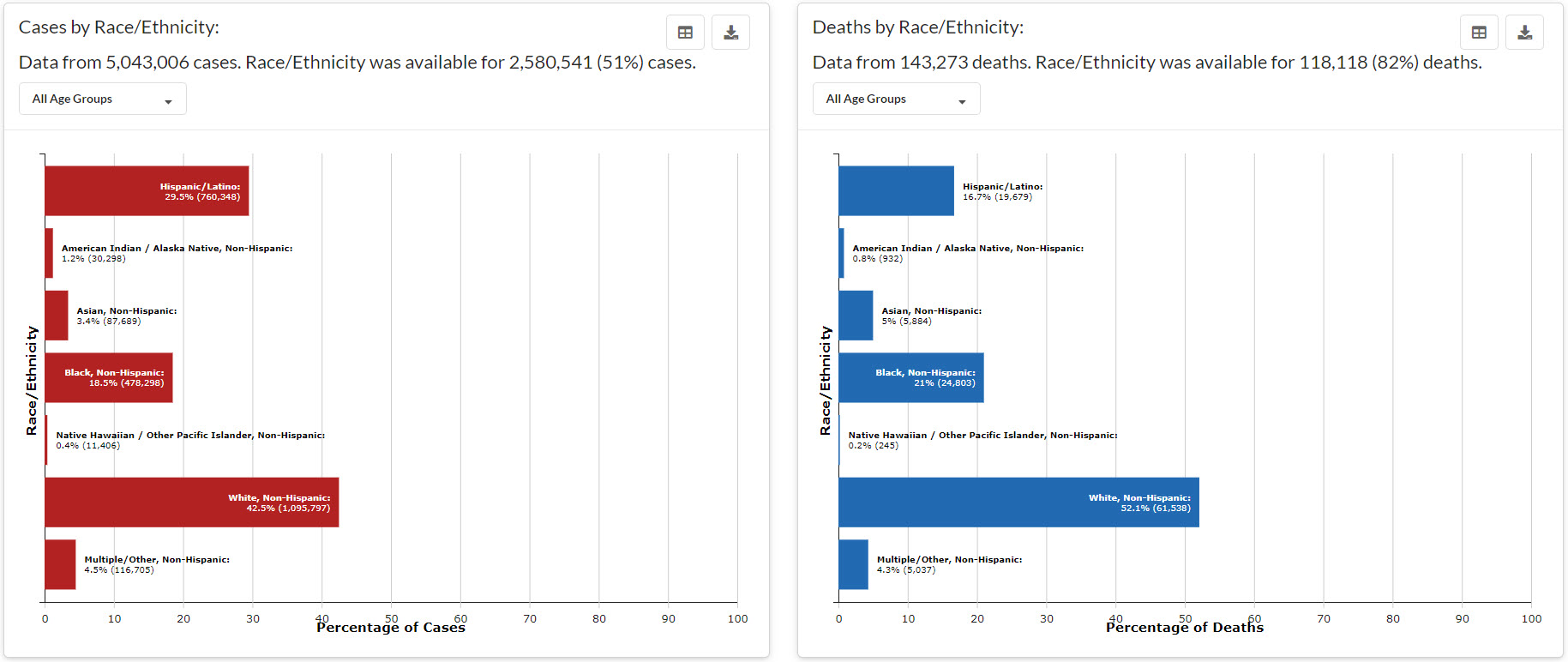

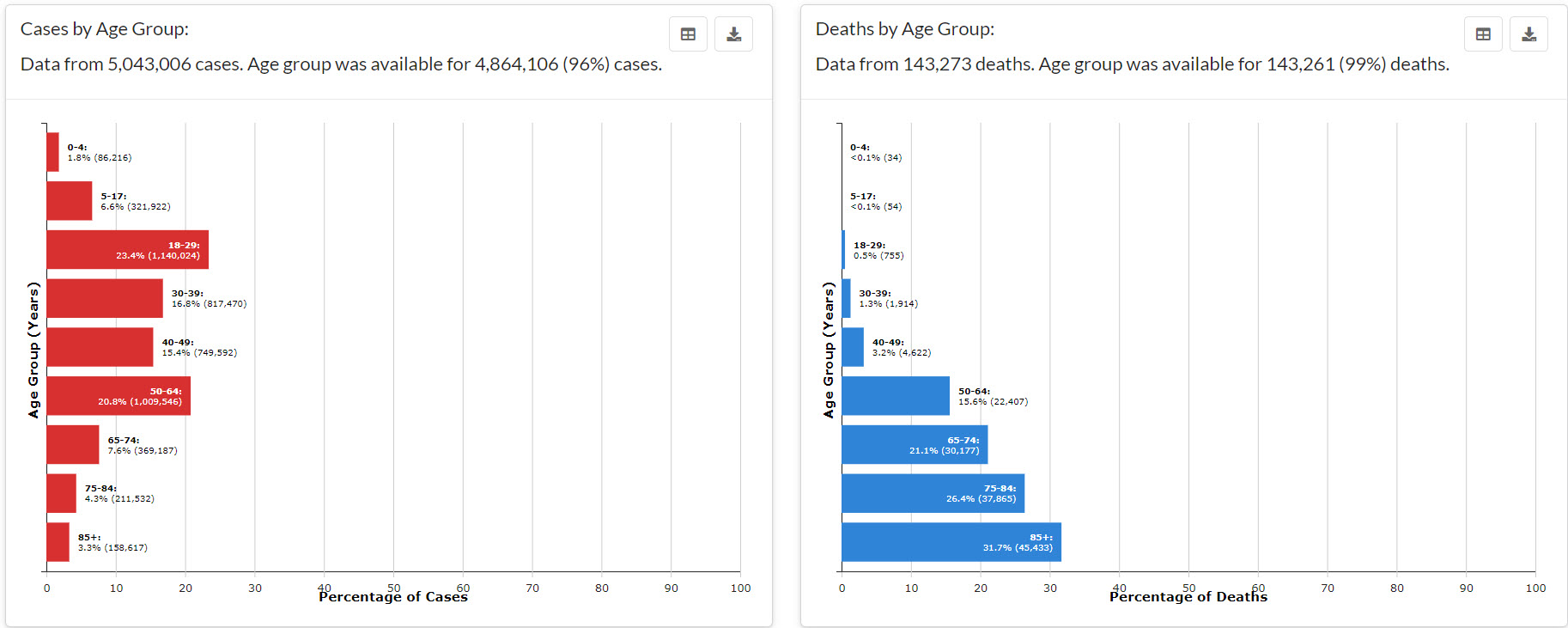

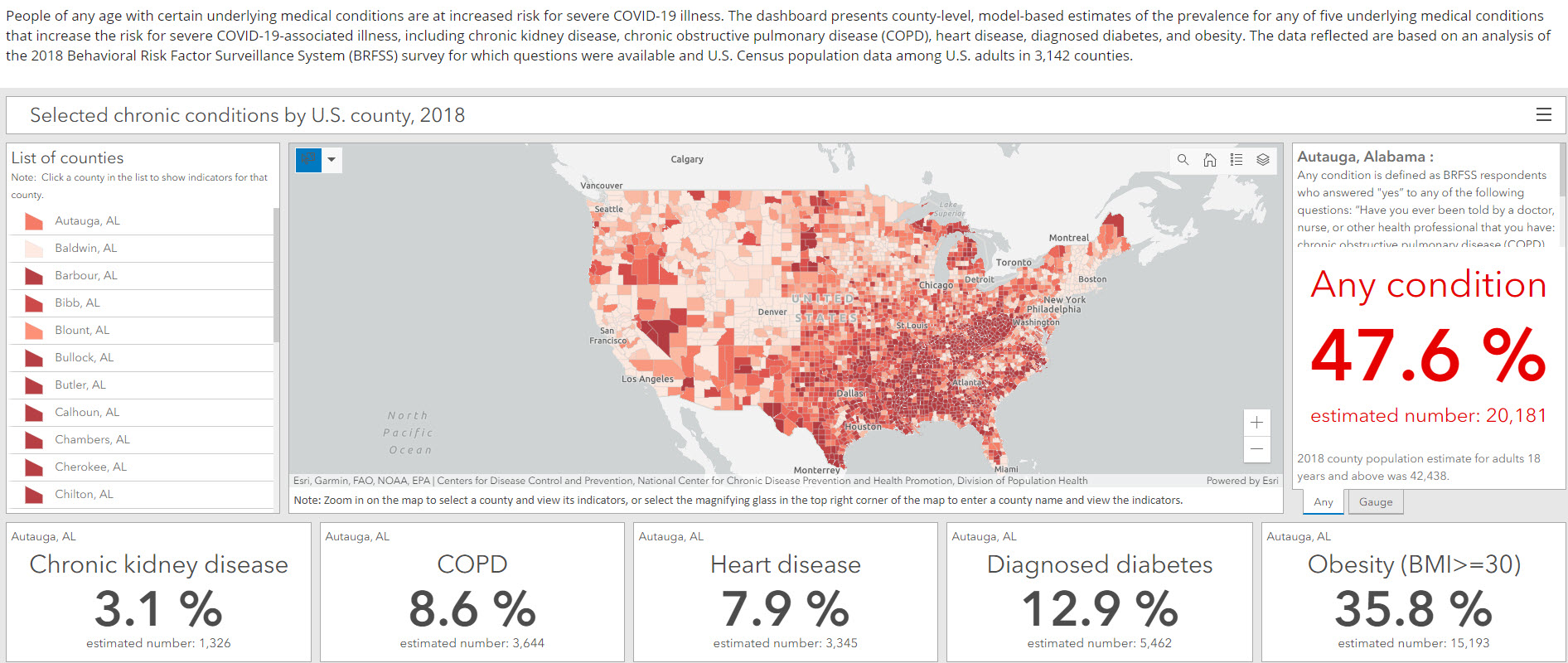

Don't get me wrong, washing hands is very good advice when it comes to preventing the spread of a virus, or any other germs for that matter. But I think we all need to remember that being healthy is not just about avoiding an illness; it’s about your body being able to fight it when you do catch something. I mean, Heart disease, COPD, diabetes, high blood pressure, high cholesterol, obesity, gum disease are all indicators of being unhealthy overall. Throw in a cold, the flu, or now the novel corona virus and, according to all reports, your chances of fighting it off drop exponentially.

How do We Fight the Good Fight?

Well, l’d like to throw out a few more options for hedging your bets for a good recovery if this novel virus does land at your door step.

If you’re reading this on my website, please, feel free to add your suggestions in the comments: I’m sure everyone will appreciate them.

Note: I am not in any way, shape, or form any part of the medical profession or community. I’m merely a fairly healthy mom with 60+ years of living under my belt who has never had the flu, has gone over five years without a head cold, and takes no meds for any health conditions. All of the actions I suggest below are based on my own experience in the workforce, reading books & newspapers, tv watching, radio listening, and observations of people around me in general. I strongly suggest you consult with a real doctor before changing any of your personal lifestyle habits.

1. Add an Extra Shower or Two Per Week

Germs can gather anywhere on your body (like a little party, hahaha!) not just on your hands. And I know a lot of you don’t do a lot of exercise in a day – especially me – or run around a lot when working, so it’s pretty common to only shower a few days a week. But maybe during this time of uncertainty with this crazy novel corona virus going around, you may want to take more precautions by adding to your daily routines. So, in addition to washing hands a gazillion times a day I would encourage everyone to consider bathing or showering every day and even washing your hair more often.

These two activities can definitely help you to wash away a multitude of bacteria and other germs...which brings this to mind:

2. Brush, Floss and Gargle Twice a Day

Do you know your mouth collects and carries tons of germs and bacteria? Click here to learn more.

In that case just think about all the stuff that comes flying out of your mouth when you sneeze – YUK!!! And then what you can breathe in when someone else sneezes – double YUK!!!

My dental hygienist used to tell me this (aka, scare the heck out of me) all the freeking time! She said my biggest defense against this bacteria growing into a huge problem (cavities and gum disease – which can weaken your immune system) was to brush, floss and gargle twice a day, every day.

In that case just think about all the stuff that comes flying out of your mouth when you sneeze – YUK!!! And then what you can breathe in when someone else sneezes – double YUK!!!

My dental hygienist used to tell me this (aka, scare the heck out of me) all the freeking time! She said my biggest defense against this bacteria growing into a huge problem (cavities and gum disease – which can weaken your immune system) was to brush, floss and gargle twice a day, every day.

Here’s a good way to remember:

- Brush (floss & gargle) every night to keep your teeth,

- Brush (floss & gargle) every morning to keep your friends

3. Make Simple Adjustments to Your Diet

I just learned a few days ago that my bad cholesterol just went up 50 points in the last year! OMG!!! So you can bet I'll be changing my diet ASAP because it's a well known fact that high cholesterol leads to heart disease... and I kinda wanna live! So I've switched from white rice to brown rice, added quinoa to my diet as well as a daily handful of almonds; YUM!

I just learned a few days ago that my bad cholesterol just went up 50 points in the last year! OMG!!! So you can bet I'll be changing my diet ASAP because it's a well known fact that high cholesterol leads to heart disease... and I kinda wanna live! So I've switched from white rice to brown rice, added quinoa to my diet as well as a daily handful of almonds; YUM!

Here are a couple other options.

- Increase your daily water intake: Six to eight 8-oz cups of water per day is ideal but anything is better than nothing.

I've not been hearing of any shortages in the stores for fresh fruits and vegetables, so...

- Make sure your diet includes 1-3 servings of vegetables per day (fresh or frozen, they're all good)

- Make sure your diet includes 1-3 servings of fruit per day (fresh, frozen, or canned w/out sugar, they're all good)

Click here to see how much is considered a serving.

It's not as much as you might think so this could be pretty easy.

- One other thing I recently learned is a great source of vitamin C is lemon water. One article said the juice from half a lemon provides all kinds of good health benefits in addition to the vitamin C. So now I buy a bag of lemons and juice them every two weeks. Add 3 tablespoons juice (Bonus - that's one serving of fruit!) to 8-oz of room-temp water with a teaspoon of honey and you are good to go! (Gotta sweeten it otherwise it's way too sour for me!)

Click her to see more about the benefits of lemon water.

Click here to see more simple suggestions for updating your diet!

4. Get Your Big Old Heart Muscle Pumping a Bit More

Don’t worry, I’m not going to suggest you all of a sudden join a gym or start doing 30 minutes of calisthenics every day day. Heck, I wouldn’t do that myself especially knowing that my picture is right next to the word, “lazy” in the dictionary!

Nope, I’m simply suggesting you just add a few minutes of extra movement to your life every day. Think of it this way, if you already do nothing, then adding 2 minutes a day is a substantial increase, right?

Nope, I’m simply suggesting you just add a few minutes of extra movement to your life every day. Think of it this way, if you already do nothing, then adding 2 minutes a day is a substantial increase, right?

Some easy ways to do this might be;

- Do a few push-ups against the bathroom counter after you get out of the shower . You can also do this in the kitchen while waiting for your morning coffee to brew or dinner to cook.

- Do a few toe-touches as soon as you get out of bed. Or before you sit down in front of the tv every evening.

- Put your hands on your hips and twist at the waist as far as you can, from left to right, for a few minutes while watching tv. Yeah, that's just a stretch, but it sure feels good!)

If you have kids you could even have them join you with some jumping jacks or slight knee-bends at every commercial break.

5. Let’s Talk About Smoking

Yeah, I know I may be pointing out the obvious here, but if I’m not, let me be the first to tell you: Smoking wreaks all kinds of havoc on your lungs and your heart! This puts you at such high risk for sooo many things, but especially the corona virus right now.

That said, I know how hard it is to quit: I used to smoke.

But I’d still say try to make even a little change. I mean, maybe if you start slow by cutting back even one cigarette a day for a week at a time, this may increase your odds of eventually quitting all together and giving your lungs a chance to survive any virus that chooses to attack. To help this along talk to your doc about some patches or picking up some Nicorette instead of a case of TP the next time you hit the grocery store. (Yes, I’m being a wiseass there, but you get the point, right?)

The other up-side to probably living longer? Think of all the money you’d save! Cigarettes are crazy expensive! And speaking of expensive...

6. Let’s Talk About Drinking

I’m not sure how it all works, but I know that not only does drinking affect your kidneys, I hear it affects blood pressure, your cholesterol and weakens on your heart. Crap, it scares the heck out of me just talking about it!

So just like smoking, save some money and raise your odds of surviving the corona virus but cutting back a little bit every day until you’re down to that one-glass of wine – or whatever it is they recommend now – each day.

So just like smoking, save some money and raise your odds of surviving the corona virus but cutting back a little bit every day until you’re down to that one-glass of wine – or whatever it is they recommend now – each day.

7. Don’t Forget to Sleep

When your body is sleeping it is repairing and rejuvenating. Every “body” needs to do this so they/it (how do I say that?) can get up and get through the next day.

Now that many of us are working from home it’s real easy to lose track of time as we type away on the computer till all hours of the night. Not only do we need to get up and move around every hour just to get the kinks out, we might have to set an alarm to remind us to just quit! And it’s not enough to quit to go to bed because, just like getting home from work, you need to quit a few hours beforehand so you can wind down from the day and relax. So maybe set an alarm to remind you that it IS the end of the work day and it’s time to go “home.” Just sayin’!

One Last Word...

Change is never easy for any of us – says the lady who has always hated computers but did PC training and tech support for almost 40 years now – so don’t feel you need to do everything on this list all at once. Remember that old adage, “everything in moderation?” Do that...in moderation.

It’d be great to hear other suggestions on what you think we can all do to stay healthy so please, leave a comment on this post. I’ll keep my eyes peeled!

Y’all take care now, ya hear?

Jan

Note: I am not in any way, shape or form, any part of the medical profession or community. I’m merely a pretty healthy mom with 60+ years of living under my belt who’s never had the flu, has gone at least four years without a head cold, and takes no meds for any health conditions. All of the actions I suggest in this article are based on my own experience in the workforce, reading books & newspapers, tv watching, radio listening, and observations of people around me in general. I strongly suggest you consult with a real doctor before changing any of your personal lifestyle habits.

Some of the most common posts I see on social media these last few months hover around a handful of conflicting statements regarding the COVID numbers and ending with, “the President is a dictator,” or “the President should have done more.”

Some of the most common posts I see on social media these last few months hover around a handful of conflicting statements regarding the COVID numbers and ending with, “the President is a dictator,” or “the President should have done more.”

We can begin with our own personal behavior: the simplest one being, if someone doesn’t agree with your opinion, shut up and LET IT GO! That’s called acting like an adult. Do not call names, do not bully, do not get violent. None of those behaviors will change anyone’s mind…whoever told you it would?

We can begin with our own personal behavior: the simplest one being, if someone doesn’t agree with your opinion, shut up and LET IT GO! That’s called acting like an adult. Do not call names, do not bully, do not get violent. None of those behaviors will change anyone’s mind…whoever told you it would?