Click this button to Save and Share a copy of this article.

My brother, a long haul truck driver, dropped in this past weekend accompanied by his co-driver, Jeremiah Johnson (yes, that’s his real name for those of you who remember that movie.) During good meals and good conversations we came around to the topic of retirement.

Jeremiah had this to say about that:

“I don’t understand. People work their whole lives and make good money. Why do so many of them struggle financially when they retire? Where do things go wrong?”

Two days later I shared this conversation with my son, who then told me he had just encountered an elderly homeless couple when he stopped in a parking lot to make a phone call. He said,

“Mom, it was so sad especially because they were your age. I can’t imagine you being in this situation...how does this happen?”

Good question. But honestly, it didn’t take me long to come up with five very solid answers. See if one or two of these don’t resonate with you.

1. Most people don’t really understand what it means to “retire” so they don’t know how to plan for it.

This is what it means to retire:

You quit your job. Voluntarily.

So what’s that look like on paper? Remember that 50k a year you were earning? Yeah, well, that goes away and now you make zero dollars. So, no more automatic payroll deposits into your bank account and no more raises (aka, “fixed income”).But guess what doesn’t drop to zero: Your financial obligations, aka, your debt. You know, things like your rent or mortgage payments, car payment, utilities, cell phone bill, credit card debt, and any insurance you have.

With that in mind, how do you think you’re going to continue to pay those bills with no income?

2. People make 50k a year, but spend like they’re making 100k.

We all do it especially as easy as it is to get caught up in the more recent trend (due to massive marketing) of using credit cards for every darn thing.

3. YOLO: You Only Live Once.

This isn’t an uncommon attitude at all. Most people under the age of 35 or 40 do this and it’s not meant as an insult. I mean, I don’t know about you but when I was in my 20’s I really didn’t give retirement a single thought, let alone a second thought. If there was any saving to be done at all it might’ve been to save for a vacation or Black Friday shopping.

4. Job loss/Layoffs

Some companies have a nasty habit of either going out of business, shutting down various locations (General Motors) or laying people off/firing them/ forcing an involuntary retirement a few years short of government retirement age. (That would be 59.5 for any 401k or Roth IRA accounts, and 62 for Social Security.)

In my experience this seems to happen when a long term employee has been working for a big company for 20+ years. While it’s illegal as hell to practice age discrimination, big corporations will find a way to work that option if they want to save money by hiring younger, lower paid workers.

AT & T for instance, laid off my husband (after 35 years) when he got hurt on the job and needed major surgery. Tom was 57. My brother’s hours were cut to 16 per week at the plastics company in Flint when he was mid 50’s so he could no longer pay his bills. Thank God I was still working full time and my brother’s wife was too, but boy did we all have to make some serious adjustments!

5. Debilitating Illness

This could include, but not by any means be limited to Cancer, Heart Disease, Diabetes, etc.

So how can you avoid becoming homeless when you’re a senior citizen?

Denying the fact that you will become a senior citizen will only get you into trouble... and possibly homeless. (Hey, with some good living, good luck and a few prayers, we will all eventually become senior citizens.)

The only way to ensure a good lifestyle in your later years is to make a plan.

You’re Never Too Young to Start Planning

I strongly suggest you think about doing this when you get your first job. No, that’s not too young; there’s no such thing as too young to plan for retirement. Just like it’s never too late either. Heck, I didn’t start till I was 40!

I strongly suggest you think about doing this when you get your first job. No, that’s not too young; there’s no such thing as too young to plan for retirement. Just like it’s never too late either. Heck, I didn’t start till I was 40! Make a plan: Five Steps to Retirement

Here are the five basic steps:

- Buy a house if, or, as soon as you can.

- Avoid debt and/or pay off as much of your serious debt as soon as possible.

- Calculate how much you think you’ll need to save/ live on in your retirement years.

- Determine the age at which you want to quit working/retire.

- Start saving ASAP: Saving’s account, 401k, 401k Roth IRA

Let’s take a closer look:

1. Buy a house if, or as soon, as you can.I know that not everyone is in a position to do this. I mean, for those who have jobs that require them to relocate every six months or every two years, such as the military, this just isn’t going to happen 'till you change jobs or retire.

Then there are those who just don’t want to be “tied down,” or “put down roots” because they have a wandering soul. And that’s fine. But keep in mind, with that type of life style, you will have zero control over the cost of your housing as time passes and you grow older.

That said, I would say that after buying a car, this is one the most important financial goals you can set for the simple reason that it’s the best rent control you can ever have.

Look at it this way: Once you have a 30-yr mortgage, your “rent” won’t go up for the next 30 years! No more $50 - $100 rent increases every six months. Then, in 30 years when that debt is paid off and you retire, you get to live rent free forever!

Yes, you will still have homeowner’s insurance and property taxes, but that will always be a small fraction of what you would pay in rent or a mortgage.

Either way, SWEET!

2. Avoid debt/pay off your serious debt.

“Serious” debt would include a house, a car, or major credit card purchases of say, over $1,000.

Seriously, paying everything off is actually doable when you start with considering a 30-year mortgage. Yes, it will take 30 years to pay it off, which seems like a long time. But look at this way: If you buy a house when you’re 30 it’ll be paid off by the time you’re 60. All you have to do is buy the right one the first time and keep it. Just avoid the temptation to up-size because everyone else is or because you just got a raise.

Then think about buying a car. Five-year car loans really are paid off in 5 years. Again, keep the same car, do the required routine maintenance, and most vehicles will last 15-20 years.

Ok, I know some of us start out with a hand-me-down junker so this might seem a little more challenging. I get it. My first car at 16 was my family's 1963 Rambler; my last was this used 2013 Dodge Ram truck. (BTW, you save a TON of money when you buy used.)

And I know it’s easy to have a need for a larger vehicle when your family grows, and then when all the kids move out you have a desire to downsize. So yeah, you may just go through a few cars by the time you’re 50 or so, but still, if you buy your last one at that age, just be serious about its maintenance and you won’t have another car payment for the rest of your life.

Also, limit your credit card usage. There’s no doubt when they offer incentives such as 15% discount and zero interest when using their store credit card, it’s a great idea. But still try to be good and just charge what you can pay off in a couple of months. Otherwise this kind of debt can follow you right into your grave!

3. Calculate how much you think you’ll need to save/ live on in your retirement years.

How much do you think you’ll need to save/ live on for those retirement years? Look at your current lifestyle: house, car pmt, credit cards. Keep in mind that if you’re paying rent rather than a mortgage, that dollar amount will continue to rise (to who knows what) after you retire, along with the cost of your utilities, gas, and food. We can’t possibly predict what all those dollar amounts will be so let’s just look at your current total monthly payments.

For example, we’ll say if you’re making $50k per year, 10% goes to taxes and 10% goes to other payroll deductions (Medicare, soc sec, etc), and the remaining 30k goes out to bills, gas and groceries.

That means that you need a minimum of 30k per year to live on. Take that 30k a year and multiply it by however many more years you think you might live after you retire.

To figure that out, let’s say you want to retire at 62 so you can collect Social Security and draw on your 401k. And you’re in reasonably good health so you believe you’ll live another 25 years after retirement bringing you to 87 years of age. Hey, it could happen! And even if you don’t, I’d suggest planning for it just in case you surprise yourself. Ha!

Either way, that would be 25 years x $30k per year = $750,000 Yikes!!! Yes, ideally you should save a three quarters of a million dollars. Yikes again!!! When someone told me that years ago, I freaked! There’s no way I could save that!

But wait!

Before you freak out, let’s re-calculate how much you need to live on each month when some of that “serious” debt is gone. I doubt you’ll need that much...I sure didn’t.

Let’s start with the house: In 30 years your house will be paid off. Remember? So imagine your house payment is $1500 per month. But part of that is taxes and insurance (say $250), so maybe you’ll no longer have $1,250 a month in mortgage payments. That’s $15,000 per year taken off that $30k per year you thought you’d need. Now you only need $15,000 per year to live on. Multiplied again by those 25 years of retirement life. Now we’re looking at $375,000 you need to save. That feels a little more doable, don’t you think? And if you get your car paid off before retirement, that’s even better, yay!!!

To see what you need to save annually, then monthly, let’s do a bit more math.

Take that 375k and divide it by the number of years you’ll be working. This is where you look at how old you are when you start saving and decide how long you should work, aka, how many years before you want to retire. Let’s say, you’re 25 now, and want to retire at 62...so that’s 37 years. At that rate, you should save $10,135 per year or $845 per month.

Yes, it sounds like a lot, but there are a few other things to factor in, such as compounded interest which means your money grows faster depending on how it’s invested while sitting in that 401k account. If you have payroll deductions for Social Security, that will also supplement your retirement income.

So please, don’t panic and give up. Something set aside, is wayyyy better than nothing and it may be just the right amount to keep you from being homeless in your senior / retirement years.

4. Determine the age at which you want to quit working / retire.

You must ask yourself at what age do you want to quit your job and rely on whatever you have in savings to live out the rest of your years. This is probably the most important factor in planning for a comfortable retirement. But before you decide, you need to be very clear on the government’s guidelines on what “retirement age” actually is.

First, if you plan on drawing Social Security, currently the youngest age you can do so is 62.

Second, the youngest age you can draw from your 401k or 401kRoth – without paying hefty penalties – is 59 1/2.

Also keep in mind that when you retire, your income, whatever it is, will now be lower than it was when you were working, and it’s also considered a “fixed income” meaning you will no longer be getting raises on a regular basis: it is what it is probably for the rest of your life. The good news is that you’ll be in a lower income tax bracket, therefore you pay a lot less in income taxes.

So let’s get back to when you want to retire.

In the previous example (question 3) we had you retiring at 62. When you look at how much you should save in an ideal world, you may want to work a bit longer. Of course if you find yourself in a position where you can save more, or your money grows in your 401k faster than anticipated, you could retire sooner. Only you can do the math and make this decision based on your circumstances. Everyone’s situation is different and there are no hard rules.

That said, keep in mind that you may have some other retirement income options. I’ve included an overview of a four of them in the following pages.

5. Start saving ASAP!

As I said earlier, there is no such thing as too young to save for retirement.

Seriously, set up a 401k as soon as your employer offers the option. Even if you don’t think you can save as much as you calculated, it’s better to save something rather than nothing.

I mean, I didn’t start my 401k until I was 40 because someone finally showed me the math (shown in the table below under the "401k" heading) and believe me, as a single mom with two kids, I didn’t save all that much. But I’m sure happy for what I did save. Again, it’s better than nothing.

Below I’ve described four common retirement income options to which most everyone has access. No matter which kind of retirement/savings account you choose to use, most of them will grow in interest over time, which means you will end up with a lot more money than what you actually put in. The reason for this is something called “compounded interest.”

Rather than inserting a techy definition for it, let me explain with the following simple example.

Compounded Interest Simply Put

Let’s say you put $20 in savings this month. You now have $20 in savings at the end of the month. And let’s say it earns 1% interest that month, which is 2 cents.

Next month you put in another $20 for a total of $40.02. You then earn 1% interest on total combined amount of $40.02, which is .4002,or 4 cents. Now you have $40.06.

The next month you put in another $20, added to the $40.06 for a total of $60.06. The 1% interest is now being calculated on $60.06...which gets you .6 cents in interest for a total of $60.12.

Basically, the interest is always being calculated on the new total balance, not just on the extra $20 you put in each month.

This is a very simplified example, but it illustrates the point that if you start doing this even with a simple interest account, you could have a lot of money saved over the course of your 35-40 years of saving.

If you invest the money in your 401k account, it could be a lot more because most times people will put that 401k money into stocks or money market accounts that pay a lot more than 1% interest.

How much does anyone save?

And in what type of account?There’s no standard: All who chose to save do it differently based on their monthly bills and what they think they can afford. And they all choose different types of accounts whether it be putting “before-tax” dollars in a 401k account, or investing “after-tax dollars” in stocks and bonds or a 401(k) Roth account. There’s no right way to do this, just do what you feel is right for you and your situation.

Sadly, not everyone chooses to save even a dime. I would say that that’s the only wrong choice because it’s a major contributing factor to the issue of so many struggling and homeless senior citizens.

Following are simple explanations for a few of the most practical and easiest to set up options.

Retirement Accounts

Many employers offer the option of setting up and managing retirement accounts for you.

If your employer doesn’t offer these, check to see if your bank or credit union does; many offer these services at no charge.

There are many kinds of retirement accounts, but I’m only going to describe the four most common: Social Security, pension, 401(k) and 40K(k) Roth (aka Roth IRA).

Social Security Accounts

This is the one your employer is required to set up by the federal government. Your Social Security account number is your Social Security number, which is why you need to give it to your employer. The payroll department will automatically deduct a certain amount (outlined in a chart by the government) from each paycheck you get and it will be deposited into your (government) Social Security account.

You cannot access this money until you turn 62, minimum. At age 62 you can apply (to the Social Security Administration) for it but you will only get a percentage of it. In other words, at 62 you might get 60 percent of what you’re entitled to, at 65 you might collect 75 percent and at 68 you might collect 100 percent. I say “might,” because I really don’t know the exact age and percentage brackets. A tax accountant or financial planner can provide the exact numbers.

Pensions

This type of retirement account is set up and run by the company for which you work. Not many companies have pensions anymore. Pensions cost employers a lot of money, which is why so many no longer offer them. (Most offer 401(k) accounts, which are explained next.)

Here is basically how pensions work:

The employer deposits a certain amount of money into each employee’s account each month for as long as the employee works for that company.

The employee can collect payments from his or her pension account after he or she has worked for the company a certain number of years and has reached retirement age. The company determines what that number of years is and what that age is.

If the company did a good job of guessing how long you will live after you retire and what it will cost you to live and maintain your current lifestyle, you should be getting pension payments close to what your salary was, for the rest of your life.

So you can see why a pension would cost an employer a lot of money. That’s why many companies no longer do this.

401(k) vs. 401(k) Roth

What’s really sad here is that I didn’t learn the difference between the two of these until I was 56 years old! You should know this sooner in life so that you make the best choice when it can really make a difference. Both of these accounts can be set up and managed by your employer.

Here are some facts and differences between the two:

The 401(k) is money deducted from your paycheck before any federal and state income taxes, and Social Security are calculated and deducted. In the long run, that means that when you pull money out of your 401(k) account you have to pay taxes on it. This is referred to as “deferred” taxes.

Surprisingly enough, this is not always a bad thing because when you retire, you no longer have that full-time, steady paycheck coming in, so your income is probably going to be a lot lower. Thus, you pay lower income taxes.

As far as I know, only an employer can set this up because only your employer can get a hold of your paycheck before taxes. But ask someone in your Human Resources (HR) department, a tax accountant or a financial planner to be sure.

Money for a 401(k) Roth account is deducted from your paycheck after all federal and state deductions are taken out of your paycheck. That means that when you retire and start taking money out of this account, you do not have to pay taxes on it. Most employers and most banks can set this up for you since you cash your check and make deposits after taxes.

While a 401(k) Roth account might sound like a regular savings account, it’s not. But it is similar to a 401(k) in these ways:

-

You should not take money out of either a 401(k) or 401(k) Roth account until you reach retirement age (59 1/2 as of this writing).

- If you make a withdrawal and do not pay it back (vs. a loan against it that must be paid back with after-tax money plus interest), you will have to pay a 10 percent penalty on that money. And, in the case of the 401(k), you would also have to pay the deferred income taxes.

You can also decide where you want the money in these accounts to be invested over the years. That can be good because you have the potential of earning a lot more interest than just the 1 percent to 2 percent that savings accounts are currently paying.

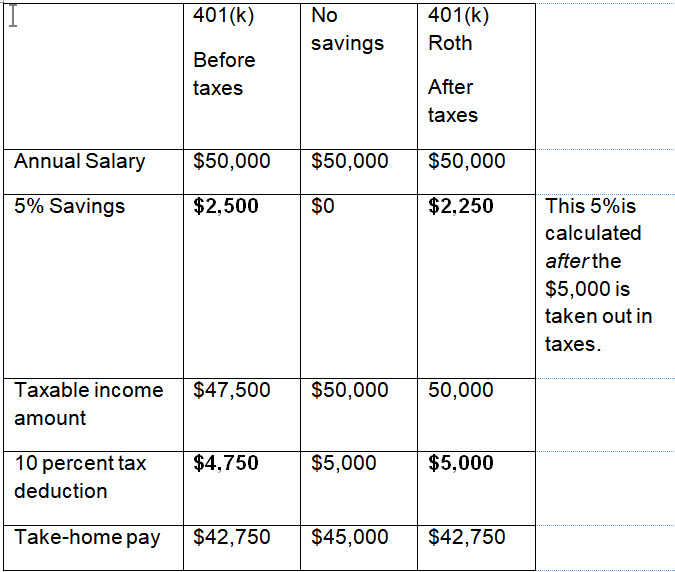

The table (shown below) is an example of three scenarios using nice, rounded numbers. It uses $50,000 per year as a salary, and 10 percent being deducted in taxes every year and what your take-home pay could look like each year depending upon how you choose to save for retirement.

You can see in the first column, if you put 5 percent into a 401(k), that would be 5 percent of your $50,000 base salary, or $2,500, going into that account. Now you still have to pay 10 percent in income taxes, but it’s 10 percent of $47,500, which is only $4,750 instead of $5000.

The example in the next column shows what it looks like if you choose not to save anything for retirement.

The third column shows what your income and then retirement account looks like if you choose to put that 5 percent into a 401(k) Roth account.

On one hand, even though you’ll have the same take home pay with a Roth 401(k), you aren’t saving as much money. On the other hand, you are paying all your income taxes up front with the Roth 401(k) and you won’t be taxed again later, like a regular 401(k).

While this is a simplified explanation of how these two accounts work, it gives you enough information to at least think about it and get started saving.

If you have questions about this and can’t decide what you want to do, talk to your parents and see what they’ve done for their retirement.

If they’ve done nothing then talk with an accountant or a financial planner. H & R Block might answer some basic questions for you for free.

You can also look up terms such as “401(k)” and “401(k) Roth” on the Internet.

Bottom Line

Whatever you decide, it’s a smart idea to do something, and to begin as young as you can – even if it’s only 1 percent of each paycheck. Who knows what kind of money you will have coming in as you grow older and when you’re 62? But with one or two of these options, you will at least have something.

Which, as I mentioned in the beginning of this paper, is not something everyone realizes they need to do until it’s too late. That is why so many elderly retirees are struggling financially (or sadly, even homeless) even after they’ve worked so hard for so many years. Bottom line,

You are never too young to start saving for your retirement.

As I continued the conversation with my son he told me that out of all the classes he ever took in high school, math was the only one that will never change, was not open to debate, nor was it just a matter of opinion: It’s fact. He said that the simple math (described here) is what convinced him to open his 401k account at the ripe old age of 19 when he was a Marine making a lot less than minimum wage.

I’ll add to that by saying the only two things you can count on in life is taxes and death. Some feel that getting older is a crap shoot, but why not hedge your bets by planning for it? That and I realized a long time ago that there is no guarantee that anyone else will take care of me if I don’t do it myself: The same could be said for you.

I hope this helps you to decide to start saving now no matter how old you are.

Sincerely,