Your kids are never too young to learn about money and where it comes from, but there’s definitely a “too old” option.

A new survey by the National Association of Personal Financial Advisors (NAPFA) reports that one in three baby boomers who are nearing or starting retirement — hasn’t done any financial planning in the last two years.

Do you know how old these people are??? THAT would be the “too old” option.

Luckily you’re probably not a Baby Boomer and neither are your children.

Toddler To Approximately 6 – 7 Years Old

Tip #1: Start Having Your Kids Do Chores.

So the cool thing is all of you, and especially your kids, are probably at a good point to start learning about money if you haven’t already. No one is ever too young and it’s almost never too late either...well, except maybe for some baby boomers. I care more about you though.

To get started, know that when you talk with your kids about money...the whole discussion has to be kept simple and age appropriate.

For instance, a toddler won’t care about budgets and bills, but he will be pretty happy to pick up pennies off the ground and put them in a piggy bank.

That's why these tips are listed in order by age-groups:

The first one, for toddlers, will be the first block in your child’s foundation of financial knowledge. Then each tip after that is added to the previous one.

You shouldn’t ever stop or cut out any of these behaviors because eventually your child will be an adult...and all adults have to know these things whether we like them or not!

One caveat: If you’ve never done any of these things with your kids and they’re now pre-teens (teens or young adults), I’d say it’s never too late to start. It’ll just be a little bit tougher to get them started on new things such as doing chores. While that task would be a good start, if they’re fighting you, you might start with tip #6 so they can have a better idea as to why the first five tips are important to them. Kids always want to know “What’s in it for me,” right? (WIFM)

So let’s assume you’re a fairly new parent of a toddler; let’s take a look at what you can teach him or her.

Did you know that researchers identified two things that people need in order to be happy and successful (click to learn more):

- The first? Love.

- The second? Work ethic.

The work ethic part of this can be taught when you start having your kids help around the house, aka, do chores.

Studies or not, I’ve always firmly believed that all members of a household should contribute something to the running of said household. In doing so, it helps kids to understand that they are useful and just as important to the family (and household) as everyone else, thus building their self confidence.

Now when I say “chores” for a toddler, I don’t mean full on laundry, dishes, vacuuming and scrubbing floors. What I mean is more simple and basic tasks such as having your little girl put all her toys back in the toy box before she goes to bed. Or helping you to carry the already folded clothes into her bedroom. In the kitchen it would be taking their dishes to the kitchen counter after dinner. (Yes, this means you should probably use non-breakable dishes such as Corelle ware, melamine or plastic.)

Now when I say “chores” for a toddler, I don’t mean full on laundry, dishes, vacuuming and scrubbing floors. What I mean is more simple and basic tasks such as having your little girl put all her toys back in the toy box before she goes to bed. Or helping you to carry the already folded clothes into her bedroom. In the kitchen it would be taking their dishes to the kitchen counter after dinner. (Yes, this means you should probably use non-breakable dishes such as Corelle ware, melamine or plastic.)

Keeping in mind that children at this age are still developing their balance and coordination so things may not be done perfectly at first, and accidents, like dropping things, will happen. This is a very important learning age for a child who loves and trusts you unconditionally therefore this is not the time to be scolding your baby for any accidents they may have. When stuff happens you need to be the adult who just corrects or fixes whatever happened while praising them for their help and the job they did do, and move on.

At Around 7 Years Old

Tip #2: Start rewarding your kids with an allowance for completing their chores.

When your kids get to around seven or eight years old you will also be adding things to the chore list such as loading the dishwasher, taking care of the pets, bringing dirty clothes to the laundry room on Friday nights, and / or making their beds each morning, etc.

Getting an allowance helps kids to understand the concept that all grownups/ everyone must to work to get money; it’s not just given to them. And the most important thing you need to remember in order to really drive this point home is to withhold said allowance until the chore is completed. (Which leads to the next important lesson about saving money.)

Getting an allowance helps kids to understand the concept that all grownups/ everyone must to work to get money; it’s not just given to them. And the most important thing you need to remember in order to really drive this point home is to withhold said allowance until the chore is completed. (Which leads to the next important lesson about saving money.)

Now I’ve heard all kinds of arguments against this whole allowance such as,

“No one pays me to clean up around the house,” or,

“This is your house too and you have an obligation to take care of it just like I do.”

Ok, I get it, and those arguments are valid. But the housework is not the point here and this isn't about you.

The point is that we are growing kids who will eventually need to know how the grownup world works so this is a learning/teaching opportunity. And yes, it sucks that your parents may not have taught you this, but really, are you going to make your kids pay for the sins of your parents? Get over yourself.

What you can tell your son or daughter is that when you work, you get paid. So this is a chance for them to see how it feels to get paid for their efforts. Yes, it’s a little more complicated in the grown up world because of bills and taxes, but you’re gonna start them out with the easy part.

Tip #3: Buy your kids two, not one but TWO, piggy banks.

Again, at the same time you start your kids on an allowance, you have the opportunity to teach them about saving money. The idea here is to teach your kids the value of saving for a rainy day, or new toy/book/bike that they can eventually buy for themselves.

Saving for something is a good way for them to eventually learn about and understand budgeting.

Saving for something is a good way for them to eventually learn about and understand budgeting.

The way to work this is to let them keep one bank – or even a change purse/ wallet – in their bedroom and the other one stays in your room...out of reach, like a real bank. Then, when they get their allowance they can then split it up between the two banks however you think is best. That could be 50/50 or 70/30...you decide.

From there you can explain to your child that the one in their possession contains the money they can spend whenever they want. And of course the one in your room is a savings account where they can save money until there’s enough there to buy that new toy/book/bike or whatever it is they want. Sort of like short-term goal setting. See? Two lessons in one!

Funny how I’m sitting here at 62 years old thinking, boy do I wish I had put more money in that second piggy bank than I did! I’ll bet even you might even be saying that – am I right?

Tip #4: Make a chart of who should do which chores and when.

After your kids have been doing chores for awhile, maybe six months to a year, they may also have figured out that Mom or Dad aren’t real good at keeping track of who’s supposed to be doing what and when.

After your kids have been doing chores for awhile, maybe six months to a year, they may also have figured out that Mom or Dad aren’t real good at keeping track of who’s supposed to be doing what and when.

So this tip serves two purposes:

-

It makes your expectations very clear as to who is responsible for what, and when.

Hm, there’s a new word, “responsible.” This is a good time for them to learn “responsibilities,” don’t you agree?

- It helps you to remember what you’ve asked of them.

Seriously, before I wrote all this down and posted it on our fridge, my kids used to really mess with me by saying,

“No Mom, Alan was supposed to load the dishwasher this week,” or

“No Mom, Jenn was supposed to clean the litter box today.”

Since I didn’t remember, it was tough to argue so I’d just get mad and yell at both of them. Yeah, that was way too much stress. So trust me, you’ll be grateful if you write it all down.

Tip #5: Encourage your kids to pick up loose change off the ground.

Ok, yeah, I know, this is a weird one. But I think it teaches us the value of money and the fact that it should never be thrown away.

For 18 years my kids and I put that free money in one of those old 5-gallon water jugs. When my kids graduated high school we had saved around $175. Then I let them roll it, take it to the bank to cash it in, and split it between themselves.

They thought it was so cool to watch that jar fill up over the years and then to see how much it really was. Not bad for just a bunch of stray pennies!

They’ve both been gone from home for over 10 years now but they both still pick up pennies...so do I...it’s a hard habit to break!

From Fifth Grade Thru Approximately 15 Or 16 Yrs. Old

I think these next two tips usually come about when your kids are getting into junior high and high school and they start asking you to buy a lot more expensive things such as smart phones, tablets, designer clothes or backpacks. It’s kind of tough when all their friends have them and their allowance doesn’t quite cover it.

Tip#6: Keep a list of the bills you pay and review it with them each month.

Making your kids aware of what it costs to live in a house (and have food, water, cars, electricity, and a cell phone) is a pretty important lesson for them to learn. It’s probably going to be pretty shocking to them too!

This tip also gives them an introduction to budgeting.

The sooner they understand the concept, the easier it’ll be when you have to explain to them that if they want a cell phone, they’ll have to get a job that pays enough to cover the cost of it. Same with getting a car.

I started going over the bills with my kids when they were in junior high. The easiest way to do this was to write up a list of the bills in a spiral notebook. Then at the top of the list I would write down how much pay I had coming in, (honestly I would put a number that reflected what was left after I subtracted out savings and gas money) and then subtract out the dollar amounts for the bills.

By fifth grade your kids can do simple math and they can see exactly what is left over at the end of the month. You can also point out how much is left for things like groceries, eating out, or movies. And this is when you could either say, “sorry, it all goes to groceries,” or some can go to groceries and then put the rest away for movies at the end of the month, or a trip to Disneyland in the fall, or new summer clothes. I’m sure you get the idea.

Sixteen Years and Up

Tip #7 Take them to a bank and open their first savings account.

Right off the get go this is going to make your teenage feel really grown up. (Boy, I sure did!)

There’s something about walking into that formal setting surrounded by all those other grownups, that just makes you feel so darn important. This ain’t no piggy bank anymore; this is real, and this is official because they have to fill out their first “official” form and actually sign it. And, this is an introduction to how the rest of the world manages money.

Wow! I get excited just thinking about what that was like when I first did it!

Anyway, as far as a debit card, those hadn’t been invented when my kids were growing up so I’m not sure how I’d handle that part of the process. But I mean, this is a savings account for something big, like their first car, so you really don’t want them to ever be tempted to drain it all for one wild and crazy night out. Sorry Mom and Dad, you’ll need to give that one some thought.

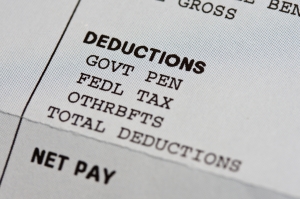

Tip#8: Explain all the information and deductions on a pay stub.

I’m guessing, by this age, your son or daughter will have gotten a part time job...or they may be thinking of one. Even if they haven’t, it’s a good time to get them thinking about what happens with a real live paycheck. (Although you may not want to share your exact income; God knows you don’t need them to blab that to all their friends!)

Ok, how many of you were stunned when your first ever paycheck wasn’t what you though it was supposed to be? Yeah, me too!

“$1.65 an hour for 35 hours should be $49.50. But wait, my check is only $30. WHAT? My boss is cheating me!”

Kids need to learn what all those deductions are for and why. It will help them to fully understand what they can or can’t do when it comes to budgeting for their first big expense such as a car payment.

Kids need to learn what all those deductions are for and why. It will help them to fully understand what they can or can’t do when it comes to budgeting for their first big expense such as a car payment.

Oh, and the why of this information is right here in these next two tips.

Eighteen To Twenty One

Tip #9: Explain how things like roads, parks, police & school teachers get paid.

Most kids are pretty shocked to learn that all their teachers are getting paid out of Mom and Dad’s paychecks by way of state and federal payroll deductions/income taxes. (More examples are included in tip #10, below.) Mine sure were.

You may even want to go so far as to even tell your kids about how streets and street lights, public parks, and schools are all being built using the same funds. Doing so just might get them to have a better appreciation for these types of things. I mean, I think it’s more personal when they know that someday it will be their money paying for it.

And I’ll tell you what, if more kids knew how this worked, they just might be less likely to swing from basketball hoops in public parks, trash public restrooms, trash schools or classrooms, or even harass all the city and county workers, including their teachers, who get paid the same way.

Surprisingly enough, telling my kids about this also made the discussion about various tax increase proposals much easier for them to understand. And that takes us to the last tip.

Tip #10: Explain where the government gets their money.

Your kids need to be aware that when the government spends money, it’s money that comes from Mom and Dad’s paycheck and eventually from their own. Be sure to emphasize the fact that the "Government” also includes salaries for all the politicians from the local mayor, right on up to the Vice President of the United States. (Usually this would also include the President, but the current President, by his choice, does not collect a salary.)

This will help them to understand the connection between a politician and said politician’s stance on how they want to spend all our tax dollars.

For instance: Cleaning up public streams, rivers and lakes, building new highways, maintaining national parks, space exploration, all things military such as bases, equipment and salaries, all things regarding prisons, again, such as the structures, salaries, food and clothing for prisoners, emergency responders, police, firefights, free housing or medical care for all Americans.

All in all, this is the tip that will get your kids ready for the number one adulting task in the country: Voting!

Remember you, me and all our kids have a dog in those fights which takes us right back to that old phrase,

"What's in it for me?" (WIFM)

Summary

I did my best to list these tips in age appropriate order for the purpose of showing you that if you start feeding your kids financial information at a young age (toddler) they may very well be ready to stand on their own two feet by the time they get out of school.

I’d love to hear any feedback or tips you might want to share with the masses so please feel free to email me directly at jan@janetmnast.com or post a comment below.

As always, I wish you luck in this wonderful but sometimes challenging journey of growing adults!

Sincerely,